New data has shown that where we live in the UK can play a big part in how well our financial plans will fare in retirement.

The new analysis comes from Hargreaves Lansdown, and is based on the concept of “pension resilience” – this is where you save enough to give you an income that hits a specific percentage of your pre-retirement salary.

What the data shows is that factors such as the local cost of living… which can vary significantly around the country, affected not least by the cost of housing.

So what are the headline stats?

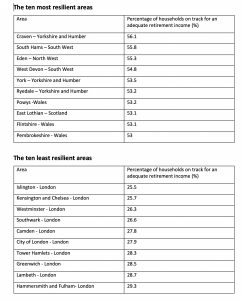

- The district of Craven in North Yorkshire came out tops, with 56% of households on track for a decent retirement income with their pension.

- There was a wide geographical split for the remainder of the top ten with Eden in the North-West, West Devon in the South-West and East Lothian in Scotland also making an appearance.

- Islington was the least resilient area in the UK when it comes to retirement, with only 25.5% of households on track for an adequate retirement income.

- The remainder of the top ten was made up of London boroughs including Kensington and Chelsea, Southwark and Greenwich.

The full list is:

Helen Morrissey, head of retirement analysis, Hargreaves Lansdown said: “The top ten is noticeable by the absence of the affluent South-East. This can be explained by the shift in methodology used to measure retirement resilience. Rather than using the pounds and pence measures adopted in Pension UK’s Retirement Income Standards the Barometer uses a target replacement rate whereby people aim for a retirement income that hits a specific percentage of your pre-retirement salary.

“This means you can maintain your pre-retirement lifestyle when you finish work and enjoy doing the things you used to when you worked.

“It’s the reason why the ten least resilient places when it comes to retirement is dominated by London. Only 25.5% of households in Islington are on track for a decent pension income followed by Kensington and Chelsea with just 26% of households on track. They are followed by the likes of Westminster, Tower Hamlets and Lambeth.

“This exposes two challenges that don’t get spoken about often enough. For a start, the higher cost of living in the South-East can make it harder to free up enough cash to save for the future as they are balancing high costs in mortgages, rents and travel. However, these households will need to save more as they will need a bigger pension to meet these higher living costs when they come to retire.”

The other issue, says HL, is that people may not actually realise they are under saving for retirement as they think the levels stipulated by their scheme will be enough. This is something that could sting high earners who have the extra cash… but don’t realise that they need to be saving more to meet their retirement needs.

“For these people there could be a nasty shock in store when they realise they are nowhere near where they need to be.”

“It’s hugely important to take the time to think about what you want your retirement to look like so you can see how close you are to achieving it. Online pension calculators can be really useful in showing what you are on track for. If you are falling short of where you need to be you can model the impact of increasing your contributions over time.”

How resilient will YOUR savings be in retirement?

The RetireEasy LifePlan takes the guesswork out of any calculations, and (critically) factor in costs that may be specific to you, such as higher housing costs.

It is the most sophisticated online calculator available to UK consumers, allowing you to feed in all of your data in just minutes and then see at a glance precisely when you can afford to retire… and how much (on your current trajectory) you will be able to spend in each year of your retirement without running out of funds.

You can then run different scenarios to show the impact of a range of potential events in the future – for example, downsizing, receiving an inheritance, helping a family member, enjoying a major holiday or taking out a lifetime mortgage.

If the sums don’t add up, you can again check at a glance what alterations you need to make in order to get your plans back on track. Importantly, you can keep abreast of any changes beyond your direct control (for instance, in interest rates or inflation) by checking your plan on a regular basis.

All this for just a few pounds a month!