A new report has revealed the real spending patterns of UK retirees for the first time… and why that can put sometimes pressure on their savings.

The median UK retiree household income is £35,000 and retirees are currently spending an average of around £22,000 a year. The “Bank of Granddad and Grandma” also includes gifting an average of £2,500 to loved ones annually.

That’s according to the inaugural “Retirement Lifestyle Report” from Quilter, the wealth manager and financial adviser, in collaboration with the Centre for Economics and Business Research (Cebr)

The research, based on a survey of 5,001 UK retirees, provides the first-ever annual snapshot of real-life retirement spending, broken down by age, gender, region, income level and relationship status.

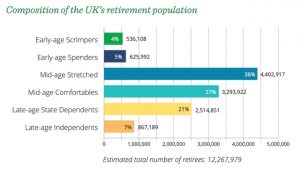

Recognising the broad spectrum of the retirement cohort, Quilter has created six retirement “personas”, largely based on age and income level, bringing to life the spending, income and general financial outlook of certain retirement typologies.

The research reveals significant income disparities, widespread reliance on the state pension, and growing anxiety among retirees about their financial futures.

For example, nearly one in five (18%) report being very concerned about their ability to maintain their current standard of living, rising to 29% of retirees aged under 65 with an above-median income.

Retirees’ biggest spending areas

Holidays, groceries and housing are the biggest areas of retirement spending – holidays and home renovations are the highest areas of discretionary spending for retirees at £2,137.34 and £1,985.26, respectively, but debt repayments and gifting to relatives are also significant.

The research also illustrates just how important retiree income is to the wider UK population: the average retiree gifts £1,323 to relatives each year and provides a further £1,175 in assistance to fund education for their grandchildren or other relatives.

This represents over 10% of their annual spending.

The median retiree household income, report Quilter, is £35,000. However, income is not evenly spread across gender and regions. Two-fifths (42%) of retirees in Wales, for example, report an income below £30,000, compared with an average of over £58,000 in London.

This leaves many retirees with very little room to save or cover unexpected expenses, after meeting their regular outgoings

Even after they have finished working, the average retiree spends more than £1,500 annually to pay down debt – although this figure declines with age.

Quilter’s research also shows that the State Pension remains a critical source of income for many retirees: among those aged 70-74, the State Pension makes up 47% of household income, jumping to 50% for those aged 80-84.

What retirees spend their money on…

| Average spend per retiree | ||

| Goods | Monthly | Annual |

| Housing (rent, mortgage, property maintenance) | £188.20 | £2,258.34 |

| Food and non-alcoholic drink (groceries) | £185.18 | £2,222.17 |

| Holidays | £178.11 | £2,137.34 |

| Renovations / Home improvements | £165.44 | £1,985.26 |

| Energy | £150.52 | £1,806.19 |

| Loan / debt repayments | £131.57 | £1,578.88 |

| Transportation (bus, car including petrol, train travel) | £119.65 | £1,435.82 |

| Phone, tv, and broadband | £117.76 | £1,413.08 |

| Healthcare (pharmaceuticals and any costs associated with healthcare) | £114.48 | £1,373.80 |

| Clothing and footwear | £113.43 | £1,361.18 |

| Gifting to relatives | £110.24 | £1,322.83 |

| Assistance in funding education of grandchildren/relatives | £97.93 | £1,175.19 |

| Gifting to charities | £87.38 | £1,048.56 |

| Dining out (food and drink away from home) | £19.61 | £235.38 |

| Electronics/gadgets | £15.30 | £183.56 |

| Hobbies (excluding sports) | £13.27 | £159.24 |

| Entertainment (theatre, cinema, live sports) | £13.24 | £158.93 |

| Sports (membership of clubs, equipment spending etc.) | £12.23 | £146.81 |

| Subscriptions | £11.53 | £138.30 |

| Total | £1,845.07 | £22,140.88 |

Commenting on the research, Steven Levin, CEO, Quilter, said: “The research paints a nuanced but urgent picture of retirement in the UK today.

“Retirees aren’t just budgeting for themselves; they’re quietly propping up the next generation too. With nearly £2,500 a year being gifted to family and to help with education of loved ones, it’s clear many are playing a bigger economic role than they’re often given credit for.

“That’s on top of rising living costs, ongoing debt repayments and increasing concerns about the future. These aren’t luxury years, they’re active financial years, and planning needs to reflect that.”

To access the full report, visit: https://www.quilter.com/4a327f/siteassets/about-us/quilter-retirement-lifestyle-report.pdf

How can the RetireEasy LifePlan ensure YOU can afford the retirement you planned for?

The Quilter report lays bare not only the calls upon retirees’ purses and wallets, but also the rising cost of living. And planning for both is essential for anyone keen to lead the retirement they have been working hard for.

The RetireEasy LifePlan, uniquely for a consumer-led planning product, allows you to enter all your expected incomes and outgoings during each of your retirement years… and then factor in variables such as shifts in inflation or rises and falls in what you can expect to receive from your investments.

It also – again uniquely – enables you to test out different future scenarios, such as assisting a family member, downsizing or paying for care.

You can then see at a glance exactly if, or when, shortfalls might occur… and take appropriate action.

Equally, if your funds look like remaining well in the black, you will have “wiggle room” to loosen the purse strings a little… and enjoy that special holiday you’ve always promised yourself!

A RetireEasy LifePlan costs just a few pounds a month, and maintaining a subscription allows you to regularly monitor and update it. If your subscription has lapsed, why not renew it today and put YOUR mind at rest about your retirement finances?