While the focus on inequality within society often looks at those late in life, a new report sheds light on problems looming for the generation heading towards retirement – not least serious levels of ageism at work

While the focus on inequality within society often looks at those late in life, a new report sheds light on problems looming for the generation heading towards retirement – not least serious levels of ageism at work

According to a new report from the Centre for Ageing Better, “Boom and Bust”, people in their 50s and 60s today – the tail end of the post-war baby boom – are at risk of becoming a “forgotten generation”, facing greater challenges than those who were the same age in 2002.

The new research, which analysed national data from almost 14,000 50-70-year-olds, found that financial inequality in this cohort has increased dramatically since the turn of the millennium. The richest people in their 50s and 60s today are twice as wealthy as the richest in this age group were 16 years before, while the poorest are almost a third poorer.

One in five say they will be unable to meet their future financial needs in old age – with a decline in home ownership meaning that many will be unable to rely on housing assets in later life.

Gender inequality is also significant: by any measure of wealth, women are approximately 10% worse off than men.

People from BAME groups are much less likely to be in the richest wealth group, and much more likely to be in the poorest.

The research raises concerns about the quality of work and degree of financial security those in their 50s and 60s are experiencing. Today, more than half of people in this group say their work is excessively demanding – almost doubling since 2002. One in three say they feel a lack of control over their work, compared to just 9% in 2002.

At the same time, there is a risk that poor health could push many out of work early, with a third of this group saying their health impacts their ability to work; meanwhile, 42% of workers in this age group also have caring responsibilities.

Th report concludes that little policy focus has been dedicated to alleviating these challenges. And, without action, many will suffer poverty, ill-health and loneliness in old age – with a real risk that the experience of later life will worsen further for future generations.

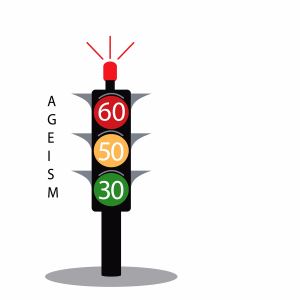

Ageism in the workplace and job insecurity

Many participants in the research – especially women – had experienced ageism in recruitment and in the workplace. Both male and female interviewees acknowledged that older women faced multiple barriers in recruitment and in the workplace. Many believed that if they were made redundant it would be harder to find work because of their age, with some noting that ageism is a gendered issue: “It is harder for older (job) interviewees, and for older women in particular”.

Women were considerably more likely to describe experiences of ageism. These included feeling patronised, invisible, and excluded. Some felt that appearing older than their colleagues meant they were in danger of being viewed as ‘past it’, not ambitious, or not worth listening to.

Several mentioned comments and “little asides” that teetered on the border between insensitive “banter” and actual discrimination.

Recommendations

Amongst the recommendations in the report are that the government should legislate for enhanced flexible working rights, carers’ leave and a single enforcement body without delay. “Government should also promote the mid-life MOT model, which gives people a focused opportunity to plan and prepare for their futures.

“Employers,” it goes on to say, “must take steps to be age friendly, including tacking ageism in the workplace and supporting older employees to manage health conditions and caring responsibilities.”

_____________________________________________________________________________________________________________

Keep ahead on your pension plans

If you’re already a RetireEasy LifePlan subscriber, you’ll know that using the programme regularly helps you keep tabs not only on how much you have saved for your retirement but also how much you’ll eventually need to retire comfortably. Remember to view your plan regularly as circumstances – such as the value of your investments or returns – can change.