Research shows cost of a comfortable retirement soars in last 12 months to £50,000 a year for a couple

Exactly how much do you think you need to retire comfortably? There’s no need to wear out your calculator batteries finding out, as the latest UK Retirement Living Standards have just been published by the Pensions and Lifetime Savings Association… with all the nitty-gritty work undertaken by the Centre for Research in Social Policy at Loughborough University.

The standards describe the cost of three different “baskets” of goods and services, established through detailed research with members of the public – and the baskets include household bills, food and drink, transport, holidays and leisure, clothing and social and cultural participation.

Critically, the Standards set out three different publicly-determined levels or lifestyles – minimum, moderate and comfortable. These are designed to help people think in concrete ways about the lifestyle they want when they retire.

The bottom line? For a Minimum Retirement Living Standard, a single person would now need £10,900 annual income, while a couple needs £16,700. For a Moderate Retirement Living Standard, one person would need £20,800 and a couple would need £30,600. Finally, for a Comfortable Retirement Living Standard, the annual budget needed by one person is £33,600 in 2021 and £49,700 for a couple… £2,200 a year up on the previous survey.

When you consider that the full state pension for 2021-22 for an individual is just £9,339 per year, it clearly delineates the need to have a fair bit tucked away in the form of investments or pensions to ensure you can live even a moderate lifestyle in retirement, let alone a comfortable one.

What that looks like in more detail

The survey goes into great detail about the sort of goods and services people would expect within the various “baskets”. For instance, when it comes to personal goods and services:

A minimum retirement living standard would give you:

Female hairdressing: £15 for a dry cut every 6 weeks

Male hairdressing: £8 a month

£25 per person, per year for perfume/aftershave

A moderate retirement living standard:

Female hairdressing: £35 every 6 weeks, plus £10 for home colour

Male hairdressing: £12 a month

Female: £20 a month for beauty treatments

£60 per person, per year for perfume/aftershave

A comfortable retirement living standard:

Female hairdressing: £90 every 6 weeks for cut and colour

Male hairdressing: £15 a month

Female: £35 per month for beauty treatments e.g. nails and/or eyebrow threading/waxing

£120 per person, per year for perfume/aftershave

Household services

A minimum retirement living standard:

No gardening or cleaning services

A moderate retirement living standard:

No gardening or cleaning services

A comfortable retirement living standard:

Gardener: Two days per year (half a day per season to help with heavier jobs), plus lawn cutting every week for six months of the year

Cleaner: Two days per year to allow for help with spring/deep clean or to clean carpets

Window cleaner: to clean outside windows every four weeks

Shopping

A minimum retirement living standard:

Food shop: mainly supermarket brands (eg Tesco)

Alcohol: three cans beer, £4 bottle of wine

Couple: £15 per couple once a month for takeaway, £15 each per

month for eating out;

Single: £10 a month for takeaway, £15 a fortnight for eating out

Celebration food and drink: £50 per household

A moderate retirement living standard:

Food shop: 50% branded goods (eg Tesco)

Alcohol: 3 cans of beer, £6 bottle of wine

Eating out and takeaway: £100 per person per month for eating out/takeaway, including alcohol

Celebration food and drink: £150 per household

A comfortable retirement living standard:

Food shop: 75% branded goods

Alcohol: three cans of beer, £8 bottle of wine

Eating out and takeaway: £50 per person per week for eating out/takeaway including alcohol. PLUS £100 per household per month to take others out for a meal

Celebration food and drink: £300 per household

Clothing

Minimum retirement living standard:

Female: Around £350 a year

Male: Around £230 a year

A moderate retirement living standard:

£750 a year for clothing and footwear per person (male and female)

A comfortable retirement living standard:

Female: £1000 for clothing per year, £500 for footwear per year

Male: £500 for clothing and £500 for footwear each year

Entertainment

A minimum retirement living standard:

Entry level smartphone

Basic TV and broadband, plus £5.99 a month for a streaming service

A moderate retirement living standard:

Samsung Galaxy smartphone

£60 monthly TV and broadband subscription, plus £5.99 a month for a streaming service

A comfortable retirement living standard:

Samsung Galaxy smartphone

£60 monthly TV and broadband subscription, plus £5.99 a month for

a streaming service

Holidays

A minimum retirement living standard:

One week off peak UK coach package holiday, plus one three-day weekend break

A moderate retirement living standard:

10 nights in the Mediterranean plus one three-day UK break

A comfortable retirement living standard:

Two weeks in the Mediterranean, One winter week in Europe

Transport

A minimum retirement living standard:

Public transport

A moderate retirement living standard:

Three-year-old Ford Focus, replaced every 10 years

A comfortable retirement living standard:

Five-year-old mid-range SUV (Nissan Qashqai) replaced every five years, PLUS, smaller run around second car for partner

How might this affect you?

There is more detail in the full report: https://www.retirementlivingstandards.org.uk/Retirement-living-standards-in-the-UK-in-2021.pdf

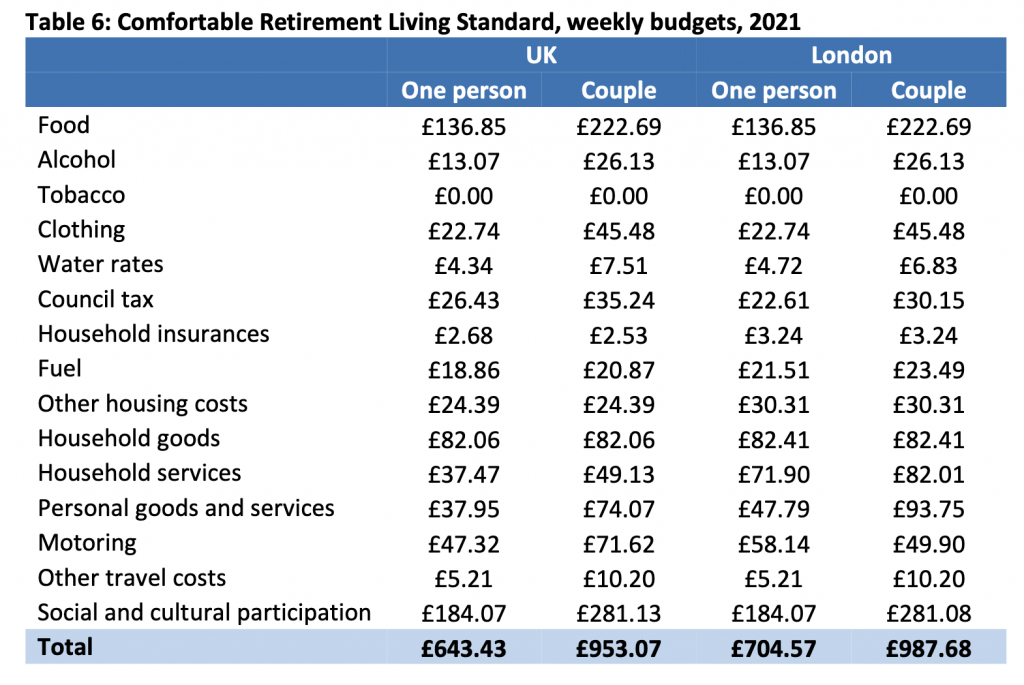

The following chart also shows the regional variations in the figures.

And if you think you might need to rethink your savings strategy as a result, why not use your RetireEasy LifePlan to see just exactly how much you might need to adjust your plans in the years to come – trying out different scenarios to judge how to best achieve your retirement plans…